Energetic Vs Passive Investing: Execs And Cons

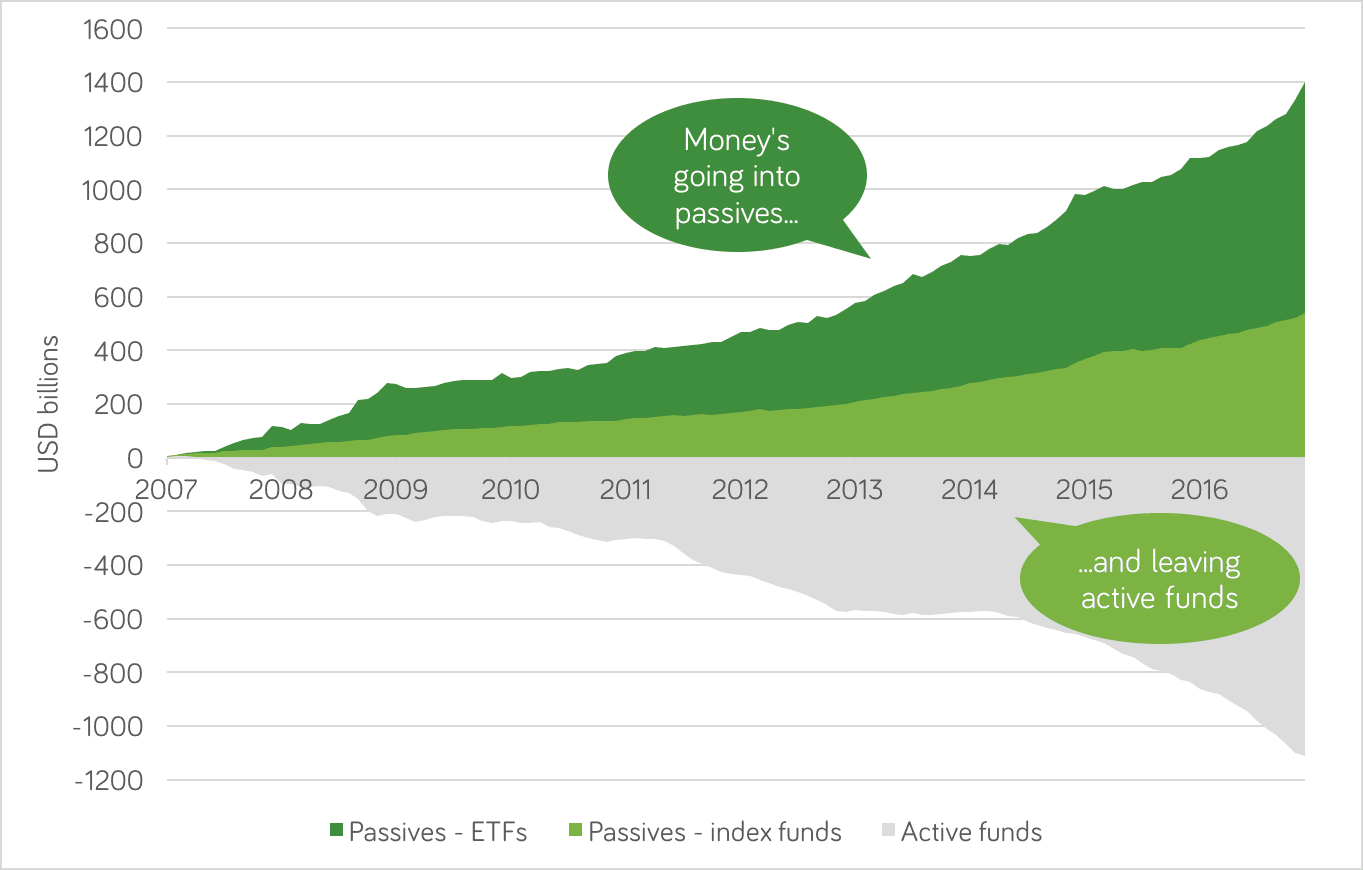

Over the past decade, inflows in the US have tilted towards passive funds as investors seek out cost-effective and broad market exposure. Passive ESG index funds provide low-cost entry to values-based investing, while active managers could go further by handpicking corporations aligned along with your beliefs. Active managers can also interact in shareholder advocacy or exclude sure industries totally. Over long intervals, similar to five or 10+ years, passive traders are probably to outperform active buyers.

Many passive funds now track ESG indices, whereas active managers choose shares based on ESG efficiency. This pattern displays rising investor demand for sustainable and socially accountable investing. Understanding the distinctions between passive vs. lively investing is crucial for buyers trying to align their technique with their monetary goals. These two approaches differ significantly in terms of cost, efficiency, risk administration, and time dedication. Index fund managers usually are prohibited from using defensive measures such as decreasing a position in shares of particular securities, even when the manager thinks these share costs will decline. In addition, passively managed index funds face efficiency constraints.

What Is The Distinction Between Active And Passive Investing?

As such, they offer traders exposure to the ups and downs of any given market or sector. Passive funds are set up to replicate the performance of a particular index. The offers that appear on this site are from corporations that compensate us. However this compensation does not influence the data we publish, or the evaluations that you just see on this site. We do not include the universe of corporations or financial presents that may be available to you. When deciding your investment strategy, consider the elements that can affect your success.

Decrease turnover also means fewer capital positive aspects distributions, which might help scale back your tax burden. When planning your monetary future, you can use energetic investing and passive investing primarily based in your particular financial objectives, danger tolerance, and the extent of “hands-on” engagement you need together with your investments. Energetic fund managers tend to charge higher fees since this technique requires a better frequency of trading and extra specialized experience. The difference won’t look like much, with annual expense ratios for actively managed funds often ranging from around 0.5% to 1.00%, compared to passively managed expense ratio charges from round 0% to 0.5%. Nonetheless, over a few years and as portfolio quantities develop, the upper charges of active can massively cut into returns. Passive investing (aka passive management) is a low-cost, long-term investing strategy aimed at matching and growing with the market, rather than trying active vs passive investing to outperform it.

Understanding Energetic And Passive Investing Methods

Many buyers discover a combination of each approaches to be the best technique. Energetic investment can deliver larger returns, however it additionally comes with higher dangers than passive investment. Any estimates primarily based on previous efficiency do not a guarantee future efficiency, and prior to making any investment you want to discuss your particular investment needs or seek advice from a qualified professional. Understanding the place and tips on how to invest your cash isn’t always simple – and that’s the place getting some financial recommendation may help. By getting to know you and what you need to achieve, a monetary adviser can construct a portfolio that suits your particular person circumstances and works hard to develop your investments over the long run. Let us allow you to realise your financial ambitions so you’ll find a way to benefit from the belongings you love.

Hybrid Approaches: One Of The Best Of Both Worlds

- Investors ought to seek financial advice earlier than making any investment selections.

- Servicemembers also could want a regular revenue from passive investments during deployments or after retirement.

- Passive funds, with their buy-and-hold approach, may be extra tax-efficient, minimizing your tax legal responsibility and maximizing your investment development.

- As A Result Of these monitor indexes, the fund manager typically can’t adapt to changing market circumstances.

- You are prepared to do the mandatory analysis and to buy particular person stocks or other investments often.

The lively versus passive divide is the necessary thing defining attribute of different fund varieties and strategies. Some of the cheapest funds charge you lower than $10 a yr for every $10,000 you might have invested within the AML Risk Assessments ETF. That’s incredibly cheap for the advantages of an index fund, including diversification, which can increase your return while lowering your threat. The trading strategy that can doubtless work higher for you relies upon a lot on how much time you want to commit to investing, and admittedly, whether or not you want the most effective odds of success over time. Eager to discover personalized investment choices and find the right fit for your financial journey? Contact Navy Federal’s Funding Services to connect with a monetary advisor in your area, or check out our online tool for do-it-yourself buyers.

Many passive traders will spend cash on passively-managed index funds, which try to replicate the performance of a benchmark index. Additionally, there is a physique of research demonstrating that indexing usually performs higher than active administration. When you add within the impact of cost — i.e. lively funds having greater charges — this also lowers the typical return of many active funds.

Passively managed belongings grew to over USD sixteen trillion, whereas actively managed assets stood at just https://www.xcritical.com/ over USD 14.1 trillion. Or, you might invest in some passive funds corresponding to for stocks, while going with energetic funds for bonds. A Lot is dependent upon your beliefs round market efficiency and your risk/reward perspective. For long-term investors, passive funds usually make sense, contemplating they have a tendency to supply larger net returns in the long term.

So, passive funds typically have lower expense ratios, or the annual value to own a bit of the fund. These lower costs are one other factor within the higher returns for passive buyers. In common, passive traders consider that markets are efficient, that means that costs accurately mirror truthful values primarily based on all out there info, with risk/reward continually priced in.

As An Alternative of continually altering your portfolio to meet the market’s situations, you buy and maintain with the objective of gradual wealth growth. Beating the market and exploiting worth fluctuations isn’t the aim. Somewhat, passive traders usually goal to earn cash by way of portfolio diversification and low-cost trading. The main differences between these approaches lie in administration type, value, and performance targets. Passive buyers purpose to match market returns at a decrease price, whereas active buyers try to exceed market efficiency, accepting further risks and charges.